Gambling Tax Changes 2026: The Hidden 10% You'll Owe (Even When You Break Even)

1/7/2026

Gambling Tax Changes 2026: The Hidden 10% You'll Owe (Even When You Break Even)

You play scratch-offs all year. You win $100,000. You lose $100,000. You break even.

The IRS says you owe taxes on $10,000 anyway.

That's the new reality starting in 2026, and if you play lottery or scratch-offs with any kind of volume, you need to understand this before April shows up with a tax bill you weren't expecting.

Quick disclosure: I'm Doug, a professional gambler with over $500,000 in lifetime winnings from poker and advantage play. I'm not a CPA or tax attorney. This is an educational overview of how these rules work, not personalized tax advice. Talk to a qualified tax professional about your specific situation before you change how you track or file.

What Actually Changed (The Plain English Version)

Starting January 1, 2026, federal tax law changed how much of your gambling losses you can deduct against your winnings.

The old rule everyone understood:

- Report 100% of gambling winnings as income

- Deduct losses up to the amount of winnings (if you qualify)

- Break-even year = zero tax liability from gambling

The new 2026 rule:

- Report 100% of gambling winnings as income

- Deduct only 90% of your losses

- Even if that's still limited to your winnings amount

- Break-even year can mean taxable income

The federal law behind this is IRC Section 165(d), modified in 2025. The statutory text is clear: your deduction for gambling losses gets limited to 90% of those losses, and it still can't exceed your wins.

Why This Matters for Lottery Players

Most people writing about this focus on sports bettors and poker players. But lottery and scratch-off players get hit just as hard, sometimes worse.

Here's why: volume.

If you're buying $20 worth of scratch-offs once a month, this won't materially change your tax situation. But if you're playing $100+ a week, cycling winnings back into more tickets, chasing bigger prizes, or tracking your play to optimize your odds (like with tools that show real-time prize data), you're exactly who this rule targets.

The 10% haircut doesn't care about your profit margin. It cares about your volume.

See which scratch-off games still have the best remaining prizes across 10 states. Real-time odds data updates every hour. Get started →

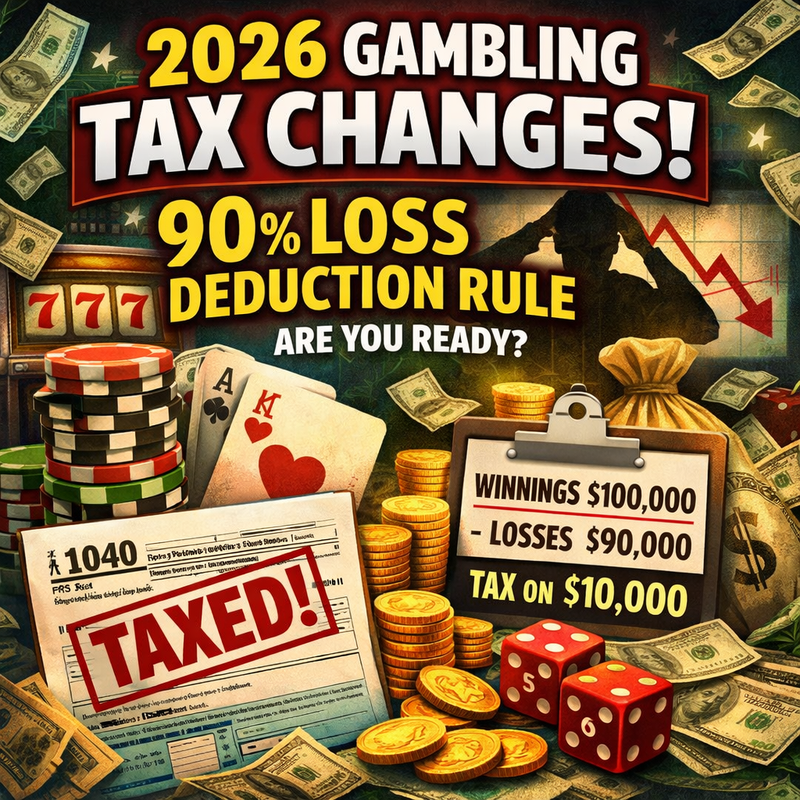

The Break-Even Nightmare (Real Numbers)

Let me show you the actual math so you understand what "90% of losses" means in practice.

Scenario 1: You Break Even

- Winnings: $100,000

- Losses: $100,000

- Your actual profit: $0

Under the old mental model, you figured: "I broke even, so my taxable gambling income is zero."

Under the 2026 rule:

- Deductible losses = 90% of $100,000 = $90,000

- Taxable income = $100,000 (winnings) - $90,000 (deductible losses) = $10,000

You pay tax on $10,000 even though you didn't actually win $10,000. That's the core shock.

Scenario 2: You're Up $5,000 (But Pay Tax Like You're Up $9,500)

- Winnings: $50,000

- Losses: $45,000

- Your actual profit: $5,000

Under the 2026 rule:

- Deductible losses = 90% of $45,000 = $40,500

- Taxable income = $50,000 - $40,500 = $9,500

Your real profit was $5,000. The IRS taxes you as if you made $9,500. That extra $4,500 of phantom income can cost you $1,000+ in federal taxes depending on your bracket.

Scenario 3: You're Down $2,000 (At Least the Loss Doesn't Make It Worse)

- Winnings: $10,000

- Losses: $12,000

- Your actual result: -$2,000

Under the 2026 rule:

- 90% of $12,000 = $10,800

- But deductions cap at winnings = $10,000

- Taxable income = $10,000 - $10,000 = $0

In a losing year, you still can't deduct beyond your winnings. The 90% limitation doesn't amplify your pain here, but it also doesn't help.

Who Gets Hit the Hardest

High-Volume Players

If you play $500+ a week across multiple scratch-off games, you're cycling serious volume through the system. That 10% haircut on losses scales with your volume, not your profit.

Professional gambling isn't about hitting one big score. It's about grinding edges over thousands of plays. The same principle applies to lottery: if you're using data to identify the tickets with the best remaining odds and playing those games consistently, you're running volume.

This rule penalizes volume. It doesn't matter if you're smart about it.

Small-Win Years

Had a year where you won $8,000 but lost $7,500? You think you're up $500. The IRS thinks you're up $1,250. That difference might not seem like much until you multiply it by your tax rate and realize you're paying an extra couple hundred bucks for phantom income.

Multiply that across every year you play, and suddenly the mathematics of "playing smart" got more expensive.

Anyone Who Gets W-2G Forms

Casinos, lottery agencies, and scratch-off retailers issue W-2G forms for wins over certain thresholds ($600 for lottery, $2000 for slots, etc.). Those forms go to the IRS.

Even if you don't itemize deductions, the IRS knows you had gambling income. If you can't deduct your losses (because you take the standard deduction), you're paying tax on gross wins with no offset at all.

The 90% limitation makes this worse for people who do itemize, because now even documented losses don't fully offset documented wins.

Track your wins and losses accurately with Savvy Scratch's play history. Know exactly which games gave you the best returns. Get started →

The Recordkeeping Reality (What You Actually Need)

If you want to deduct gambling losses under the new rules, you need documentation. The IRS is specific about this:

Minimum Requirements:

- Date and time of each gambling session

- Location (store, lottery retailer, online platform)

- Type of game (which scratch-off game, what lottery)

- Amount wagered

- Amount won or lost

- Supporting documents (tickets, receipts, statements)

For lottery and scratch-off players, this means:

- Keep losing tickets (or at least photographs)

- Log wins immediately (before you lose track)

- Note which game each ticket came from

- Track your net result by session, not just by big wins

Most lottery players don't do this. They buy a ticket, scratch it off, and if it loses, it goes in the trash. If you're playing casual volume, that's fine. But if you're playing serious volume and might want to deduct losses, you need a system.

The new 90% rule doesn't change the documentation requirements. It just makes accurate records more important, because now you're fighting for 90% of your losses instead of 100%.

What About Professional Gamblers?

The IRS distinguishes between "recreational" and "professional" gamblers. If you're treated as a professional, you report gambling income and expenses on Schedule C (business income) rather than as miscellaneous itemized deductions.

The new statute explicitly includes "expenses incurred in carrying on wagering transactions" in the pool of deductions limited to 90%. That wording is broad enough to catch travel expenses, software costs, subscription fees for odds-tracking tools, and other business-related gambling costs.

For lottery and scratch-off players, this is less common. Most people aren't running a full-time scratch-off business. But if you are or your a content creator, or if you're trying to qualify as a pro for other gambling activities, you need to understand that the 90% haircut applies to more than just losing tickets.

Don't self-diagnose whether you're a professional gambler for tax purposes. That determination is fact-specific, contentious, and requires a CPA who understands gambling taxation.

Practical Steps for 2026 (What to Do Now)

1. Start Tracking Like It Matters

Even if you think you're break-even or up slightly, start logging wins and losses now. Use a spreadsheet, a notes app, whatever works. Date, game, amount wagered, amount won/lost, location.

If you're using tools that track odds or prize data, export your play history regularly. Digital records are better than handwritten logs for IRS purposes.

2. Stop Assuming Break-Even Means No Tax

If you churn volume and end the year flat, you might still owe tax. This is the biggest mindset shift for 2026.

Set aside a percentage of your wins during the year (5-10% depending on your volume and tax bracket). Don't wait until April to realize you owe money you already spent on more tickets.

3. Understand What Counts as "Winnings"

W-2G forms matter, but they're not the entire universe. You're required to report gambling winnings even if you don't receive a form. That includes:

- Small scratch-off wins under $600

- Lottery wins under threshold amounts

- Any other gambling income

The IRS position is clear: all gambling income is taxable, whether or not it's reported on a W-2G.

4. Talk to a Tax Pro Before Year-End

If you gamble at meaningful volume, schedule a conversation with a CPA before December. Ask specifically:

- Should I itemize given my gambling volume?

- How do I document losses properly?

- What's my expected tax liability under the 90% rule?

- Should I change how I structure my play?

Waiting until filing season means you're stuck with decisions you can't undo.

5. Don't Ignore State Rules

This is federal law. States have their own rules about gambling income, loss deductions, and recordkeeping requirements. Some states don't let you deduct gambling losses at all.

If you play across multiple states (common for lottery players near state borders), you need state-specific advice. A CPA who handles multi-state gambling returns is worth every penny.

The Lottery-Specific Angle: Why This Hurts More Than You Think

Most articles about the 90% rule focus on casino players and sports bettors. But lottery and scratch-off players face unique challenges:

1. High Turnover with Small Margins

Buy a $20 ticket, win $15, use that $15 to buy another ticket. Over the course of a year, you might cycle $10,000+ through lottery purchases even though your net spend is only $1,000.

Under the old rules, if you documented everything properly, your wins and losses mostly canceled out. Under the new rules, that 10% haircut on losses means you're getting taxed on volume, not profit.

2. Retailer Practices Create Gaps

Lottery retailers don't always track purchases and wins the way online casinos do. If you buy tickets with cash, there's no automatic record. If you win small amounts, you might cash them at the counter and immediately buy more tickets without logging anything.

That creates documentation gaps. And under the 90% rule, documentation gaps cost you money.

3. Odds-Based Play Gets Penalized

Let's say you use real-time odds data to identify which scratch-off games still have the best top prizes remaining. You focus your play on those games, buying multiple tickets per session.

You're making smarter plays than the average lottery player. Your expected return is higher. But your volume is also higher, which means the 10% loss haircut hits you harder than casual players.

The tax code doesn't reward smart play. It penalizes volume.

Want to play smarter despite the new tax rules? Savvy Scratch shows real-time odds across 10 states, updated hourly. See exactly which games have the best remaining prizes before you buy. Get started →

FAQ: Quick Answers to Common Questions

Q: Does this apply to scratch-offs and lottery?

Yes. The 90% limitation applies to all wagering transactions, including lottery, scratch-offs, casino games, sports betting, poker, and any other form of gambling recognized by federal law.

Q: Can I just report my net wins and losses instead of gross amounts?

No. IRS guidance is clear: you report gambling winnings separately from losses. You don't net them on your return. Winnings go on one line, losses (if you qualify to deduct them) go elsewhere.

Q: What if I don't itemize deductions?

If you take the standard deduction, you generally can't deduct gambling losses at all. The 90% limitation is irrelevant if you're not deducting losses in the first place.

But you still have to report gambling winnings as income. That's the worst-case scenario: taxed on wins, no deduction for losses.

Q: Is this permanent or might it change?

As of now, this is the law for 2026 and beyond. There have been attempts to repeal or modify it, but nothing has passed. Plan for the rule that exists today, not the one you hope might exist next year.

Q: What about state taxes?

This is federal law. States set their own rules. Some states tax gambling income aggressively and don't allow loss deductions. Others follow federal guidelines. Some have no income tax at all.

Ask a tax professional about your specific state, especially if you play in multiple states.

Q: I only play $20-50 a month. Does this matter for me?

Probably not significantly. If you're a casual player taking the standard deduction, the new rule doesn't materially change your situation. You weren't deducting losses before, and you're still not now.

But if you ever increase your volume or start itemizing, the rule kicks in immediately.

Final Thoughts: Volume Just Got More Expensive

The 2026 gambling tax change isn't a minor tweak. It's a structural penalty on volume.

For casual lottery players who don't itemize, nothing changes. For high-volume players who track their play, optimize their odds, and run serious volume through the system, this rule adds real friction.

The mathematics of advantage play just got 10% harder. Break-even isn't break-even anymore. Small wins cost more than they should. And if you're using data-driven tools to make smarter lottery decisions, you're now paying a premium for the privilege of being smart about it.

I'm a professional gambler, not a tax professional. Bring your real numbers, your play history, and your questions to a CPA who understands gambling taxation. Make a plan before you put serious volume through 2026.

About the Author

Doug is a professional gambler with over $500,000 in lifetime winnings from poker, blackjack card counting, and casino advantage play. He founded SavvyScratch to bring professional gambling discipline to lottery odds analysis, providing real-time data on scratch-off games across 10 states.

Related Resources:

- Scratch-Off Tickets With the Best Odds: A Practical, Data-Driven Guide

- Why Top Prizes Are the Only Thing That Actually Matters in Scratch-Offs

- How to Win at Scratch Offs: The Smart Way to Play Lottery Tickets

- SavvyScratch Pricing: Why It Costs $5/Month (And Why That's Actually Cheap)

- IRS Form W-2G Information for Lottery Players

Make smarter lottery decisions with real-time odds data. Savvy Scratch tracks prize availability across 10 states, updated every hour. See which games have the best remaining top prizes before you buy. Get started →